Can a small cut from your monthly salary — say ₹2,500 — really turn you into a crorepati one day?

For most people, it sounds like a dream. But the power of compounding in mutual fund SIPs (Systematic Investment Plans) can make this dream a reality. Let’s break it down in simple words.

What Is a SIP and Why It Works Like Magic?

A SIP allows you to invest a fixed amount every month in a mutual fund. Over time, your money grows along with market returns.

The real magic comes from compounding — your returns also start earning returns. Even a small amount like ₹500, ₹1000, ₹2,500, when invested consistently, can multiply into huge wealth over decades.

₹2,500 SIP to ₹1 Crore: The Calculation

Let’s assume an average annual return of 12%, which is common in equity mutual funds over the long term.

- Monthly SIP: ₹2,500

- Expected Return Rate: 12% annually

- Target Amount: ₹1 Crore

With these numbers, it will take around 30 years of disciplined SIP investing to reach ₹1 Crore.

Your invested amount in 30 years will be just ₹9 lakhs (₹2,500 × 12 × 30). The rest — a massive ₹91 lakhs — comes purely from returns. That’s the power of compounding.

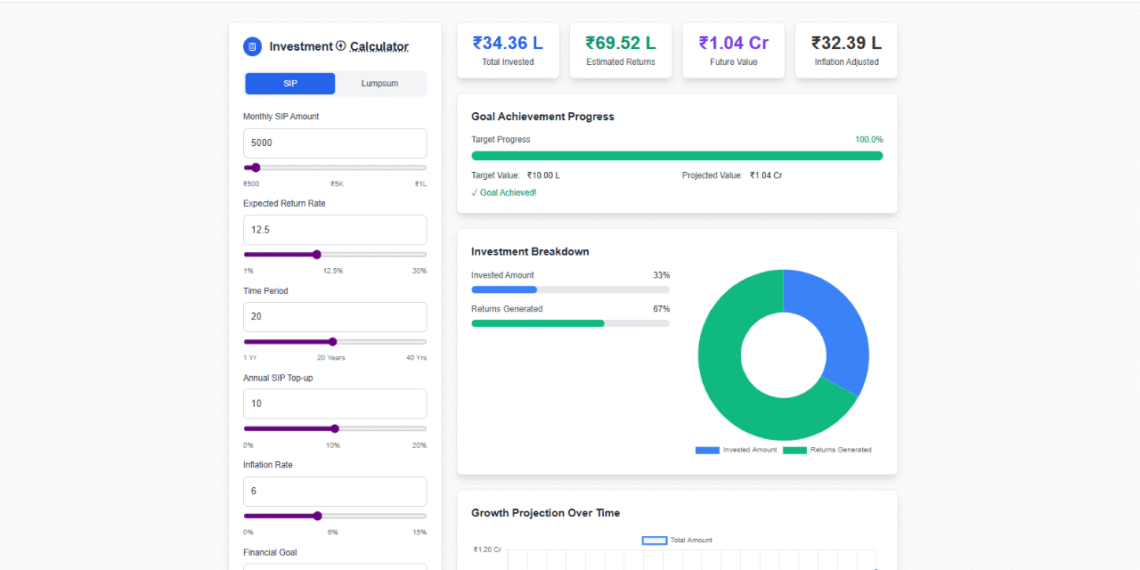

Try It Yourself: SIP Calculator

Want to see how much your SIP can grow? Use the calculator below.

Enter your monthly amount, expected return, and years.

Once you click Calculate Now, you’ll be redirected to the full calculator tool.

📈 Mutual Fund SIP Calculator and Lumpsum Calculator

Example Scenarios for ₹2,500 SIP

To give you perspective, here’s how your ₹2,500 monthly SIP grows at different return rates:

| Annual Return Rate | Time to Reach ₹1 Crore |

|---|---|

| 10% Annual Return | 34 Years |

| 12% Annual Return | 31 Years |

| 15% Annual Return | 27 Years |

SIP vs Lumpsum: Which Is Faster to ₹1 Crore?

- A SIP is safer and disciplined because you invest gradually.

- A lumpsum grows faster if invested at the right time, but carries a higher risk.

For most investors, SIP is the smarter way to build long-term wealth.

Tips to Reach ₹1 Crore Faster

- Increase SIP amount gradually — step-up SIPs can double your wealth over time.

- Stay invested for long periods — don’t stop mid-way.

- Choose growth-oriented funds — equity mutual funds work best for long horizons.

- Reinvest gains — avoid withdrawing early.

Frequently Asked Questions (FAQs)

Final Thoughts

A ₹2,500 SIP may look small today, but if you stay disciplined, patient, and consistent, it can make you a crorepati in the long run. The best time to start investing was yesterday — the second-best time is today.

Disclaimer

Mutual fund investments are subject to market risks. Past performance is not indicative of future results. Please consult a financial advisor before making investment decisions.

About the Author

This article is written by Himanshu Grewal, a finance enthusiast who simplifies personal finance and investment strategies for everyday investors. He regularly shares insights on SIPs, wealth building, and money management.