Is your bike insurance policy about to expire?

Or perhaps it has already lapsed?

Worrying about finding the time to visit an agent or an insurance office is a thing of the past. Today, you can renew your two-wheeler insurance from the comfort of your home in just a few minutes.

This guide provides a simple, step-by-step process for renewing your bike or scooter insurance online.

We will walk you through every stage, from entering your vehicle details to receiving your digital policy document. By following these steps, you can ensure your ride is always protected, legally compliant, and ready for the road.

Why You Can’t Afford to Ride with Expired Insurance

Before we dive into the renewal process, it’s important to understand why keeping your bike insurance active is so crucial.

- It’s a Legal Requirement: Under the Motor Vehicles Act, 1988, it is mandatory for every vehicle on Indian roads to have at least a third-party liability insurance policy. Riding without valid insurance can lead to heavy fines, penalties, and even imprisonment.

- Financial Protection: Insurance acts as your financial safety net. In case of an accident, it covers the costs of damages to your vehicle and, more importantly, covers any liability arising from damage to another person’s property or injury to them.

- Protection Against Theft and Damage: A comprehensive policy protects you financially if your bike is stolen or damaged due to natural disasters like floods and earthquakes, or man-made events like riots and vandalism.

- Peace of Mind: Knowing you are covered in case of an unforeseen event gives you the confidence to enjoy your ride without worry.

How to Renew Your Bike Insurance Online: A Step-by-Step Guide

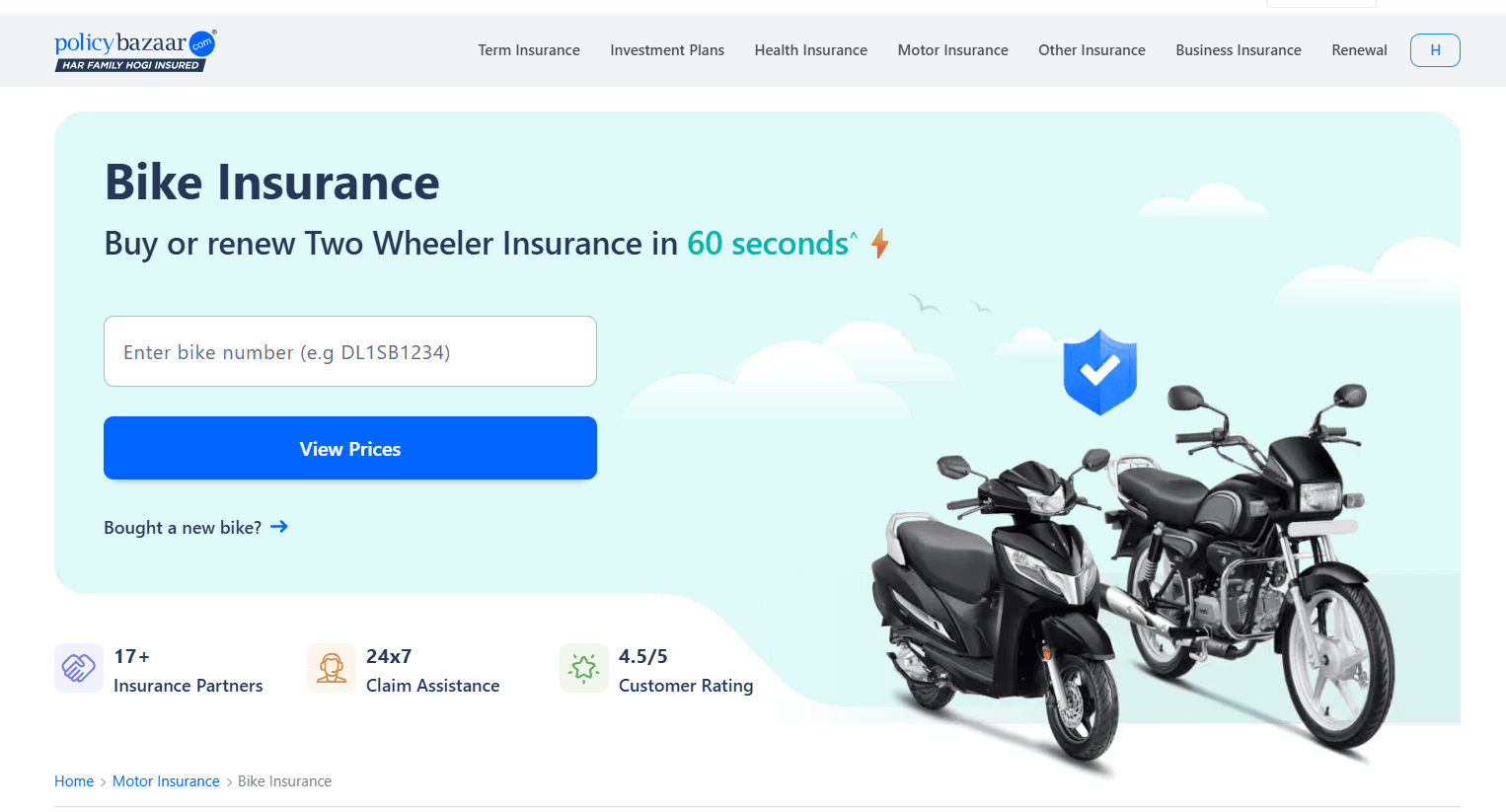

Renewing your policy online is incredibly straightforward. We will use a popular insurance marketplace like Policybazaar as an example, as the process is similar across most online platforms.

Step 1: Visit an Online Insurance Portal

First, you need to go to an online insurance comparison website.

These platforms allow you to compare quotes from multiple insurance companies in one place, helping you find the best deal. For this guide, we’ll navigate to the two-wheeler insurance section on the Policybazaar website.

Step 2: Enter Your Bike or Scooter Number

Once you are on the correct page, you will see a prominent field asking for your vehicle’s registration number.

- Enter your bike or scooter number (e.g., DL-01-AB-1234).

- Click on the “View Prices” or a similar button.

The system will use your vehicle number to fetch its details from the RTO database, including the make, model, variant, and registration year. This saves you from having to enter all this information manually.

Step 3: Verify Your Vehicle Details

The platform will display the details it has found. Take a moment to check if everything is correct:

- Make and Model: For example, Royal Enfield Bullet 350cc STD.

- Registration Year: The year you first registered the vehicle.

- Registration City: The RTO where it was registered.

If any detail is incorrect, you can use the ‘Edit’ option to make changes. Accurate information is essential for getting the right premium quotes.

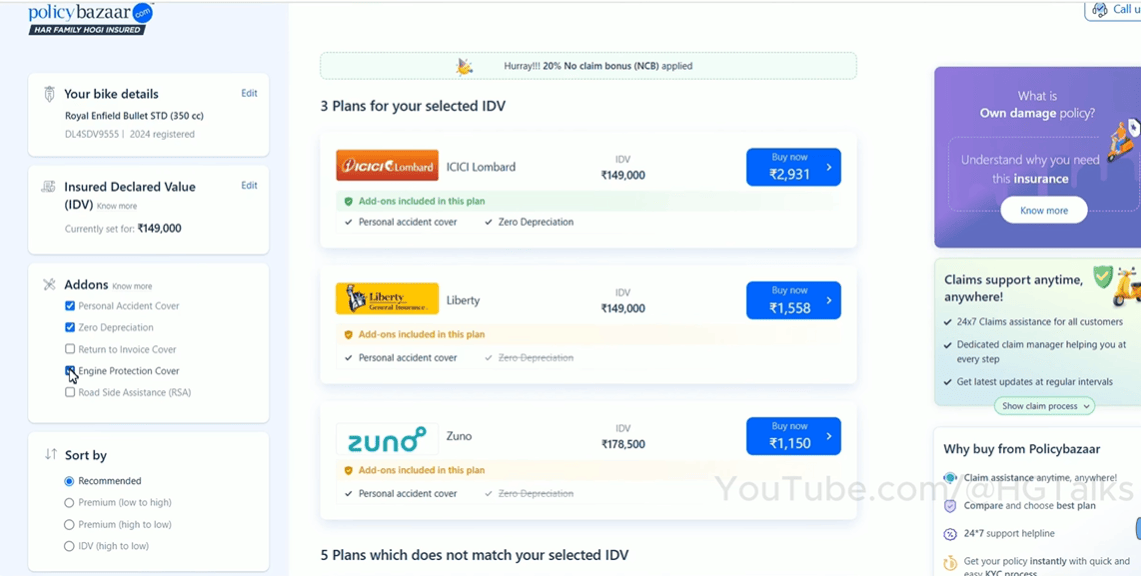

Step 4: Compare Different Insurance Plans

After verifying your details, the website will present you with a list of available insurance plans from various companies like HDFC Ergo, ICICI Lombard, SBI General, and more.

Here, you need to understand a few key terms to make an informed decision:

- IDV (Insured Declared Value): This is the maximum amount the insurance company will pay you if your bike is stolen or damaged beyond repair (a total loss). Think of it as the current market value of your vehicle. You can often adjust the IDV within a certain range. A higher IDV provides more coverage but results in a slightly higher premium. A good rule of thumb is to set the IDV about 10-15% lower than your previous year’s value to account for depreciation.

- Add-Ons: These are optional covers that enhance your basic policy. Common add-ons include:

- Zero Depreciation Cover: Also known as “bumper-to-bumper” cover, this ensures you get the full claim amount for replaced parts without any deduction for depreciation.

- Personal Accident Cover: This provides financial compensation to the owner-driver in case of accidental death or permanent disability. It is a mandatory add-on.

- Engine Protection Cover: This covers damage to your bike’s engine, which is often not included in a standard comprehensive policy.

- And many more.

Step 5: Customize Your Policy

Now it’s time to tailor the policy to your needs.

- Adjust the IDV: Use the slider or options to increase or decrease the IDV. Watch how the premium amount changes in real-time.

- Select Add-Ons: Tick the boxes for any add-ons you wish to include. The premium will be recalculated each time you add or remove one.

Take your time to find the right balance between adequate coverage and an affordable premium.

Step 6: Choose Your Preferred Insurer

Once you are satisfied with the coverage and the premium, select the plan you want to purchase. For this example, let’s say we choose the plan from ICICI Lombard. Click on it to proceed.

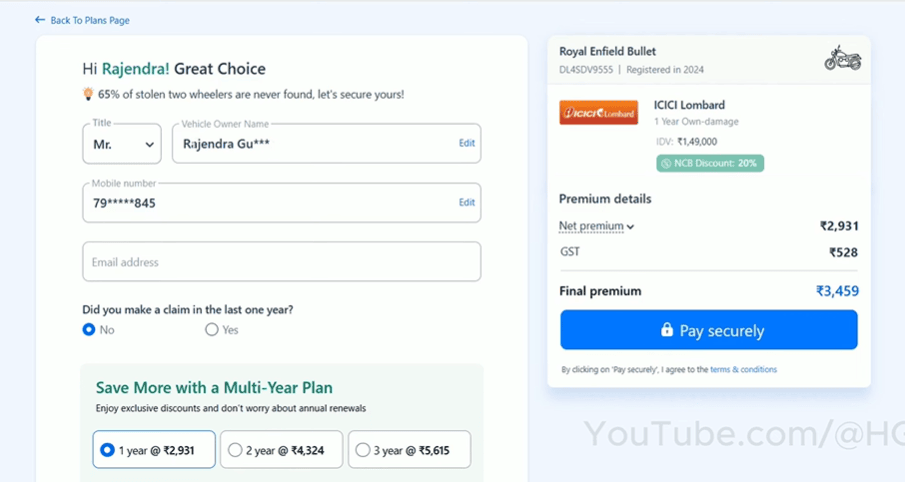

Step 7: Owner Details

On the next page, you will need to provide some personal information:

- Owner’s Name: As mentioned in the RC (Registration Certificate).

- Mobile Number: For communication and OTP verification.

- Email Address: Your policy document will be sent to this email ID.

- Communication Address: Your current residential address.

You will also be asked about your previous policy and claim history. A crucial question is: “Did you make a claim last year?”

- If you did not make any claims in the previous year, select ‘No’. This makes you eligible for a No Claim Bonus (NCB), which is a discount on your premium.

- If you did make a claim, select ‘Yes’. Your premium will be slightly higher as you won’t get the NCB discount.

Finally, you will need to enter nominee details (name, age, and relationship). The nominee is the person who would receive the claim amount in the unfortunate event of your demise.

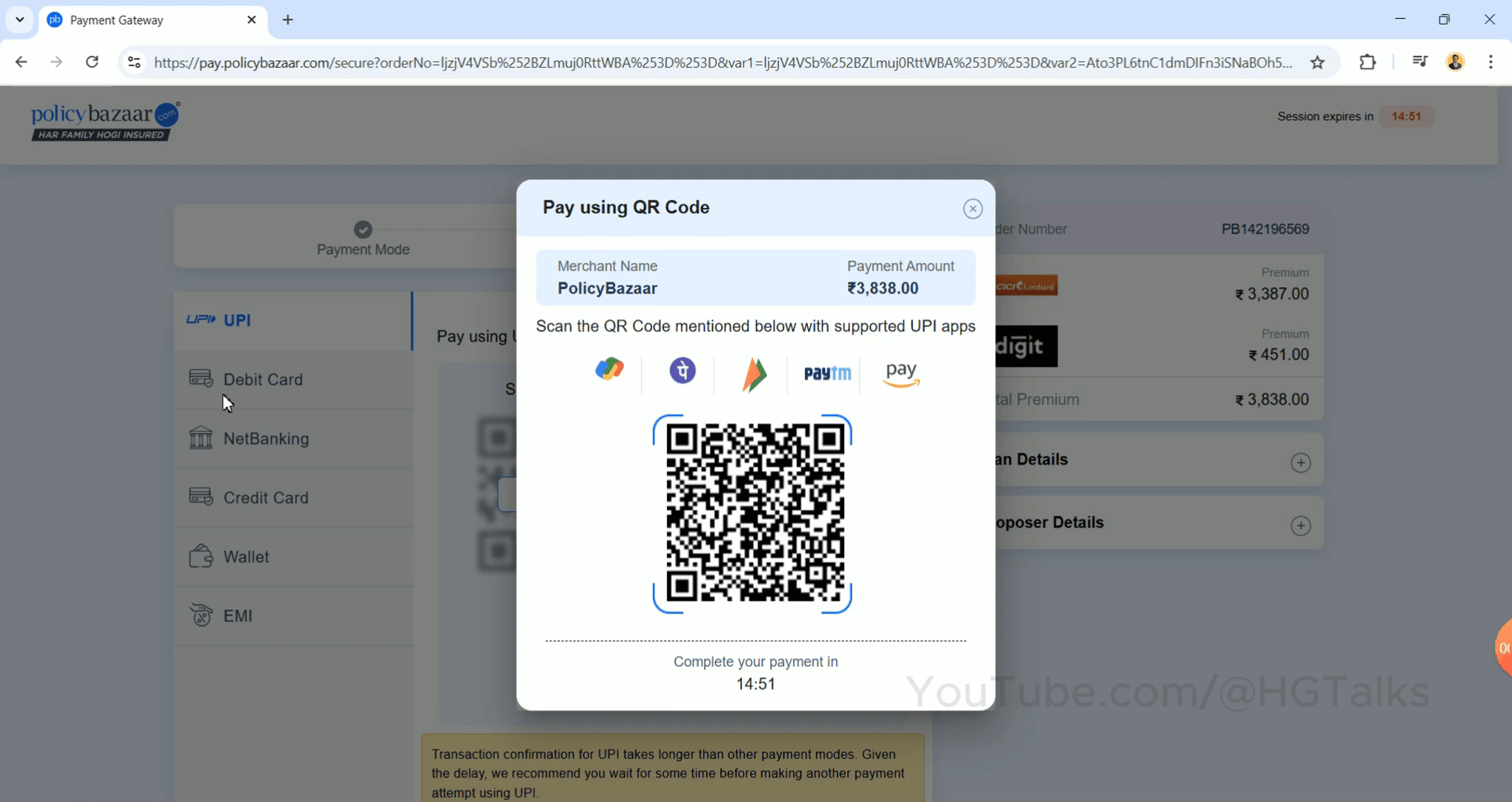

Step 8: Proceed to Secure Payment

After filling in all the details, click the ‘Pay Securely’ button. You will be redirected to a payment gateway with multiple options:

- QR Code (UPI)

- Debit/Credit Card

- Net Banking

- Wallets (Paytm, PhonePe, etc.)

Choose your preferred method and complete the transaction. The process is fully secure and encrypted.

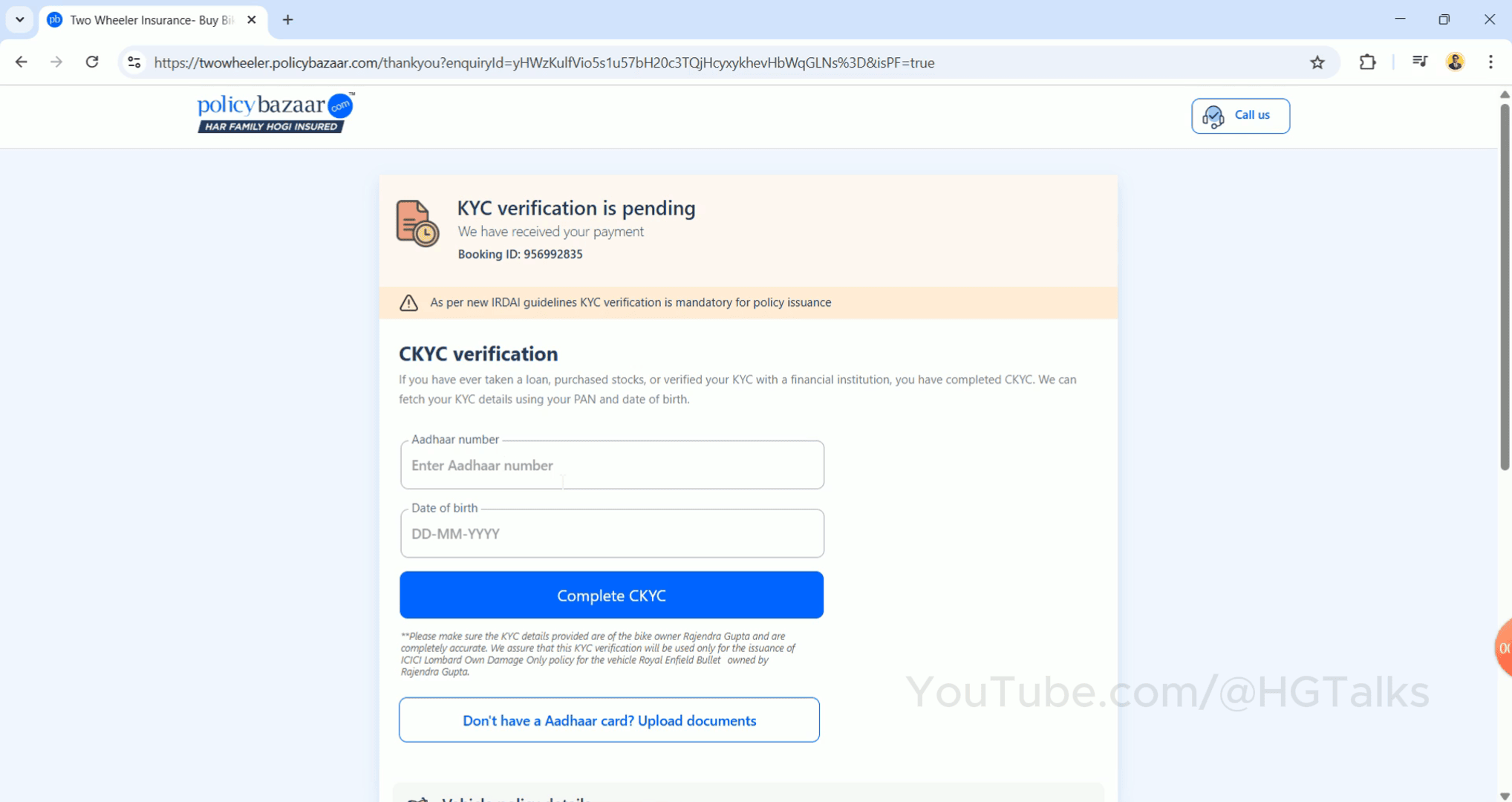

Step 9: Complete eKYC (If Required)

If your previous policy has already expired, the insurer might ask you to complete a quick verification process. This is often a simple self-inspection or an eKYC.

- For eKYC: You may need to enter your Aadhaar card number and Date of Birth to complete the verification instantly.

- Document Upload: Alternatively, some insurers might give you an option to upload documents like your Aadhaar card, Driving License, or Voter ID (both front and back sides).

This is a standard procedure to verify your identity and vehicle details.

What Happens Next? Your Policy Is Ready!

Congratulations! You have successfully renewed your bike insurance online.

Immediately after the payment is confirmed, your policy document will be generated and sent to your registered email address as a PDF file. You can download it, save it on your phone or in DigiLocker, and it is recommended to print a copy to keep in your bike’s storage compartment.

The entire process, from start to finish, rarely takes more than 10-15 minutes. It’s fast, convenient, and allows you to compare options to ensure you are not overpaying for your insurance.

Frequently Asked Questions (FAQs)