So, you’re planning to take a ₹5 lakh loan — maybe for a dream vacation, home renovation, medical emergency, or to fund your startup?

Before you go ahead, have you wondered:

- How much EMI do you actually pay each month?

- What difference can your interest rate and tenure make?

- How much extra do you pay by the end of the loan?

Most people jump straight into applying, only to get surprised later by the total repayment amount.

But you’re smarter.

You’re researching before borrowing — and that’s exactly where this guide helps.

Here’s a real breakdown of what your monthly EMI could look like in 2025, using the latest interest rates. Plus, I’ll show you how to calculate it manually and also how to do it easily using my Free AI EMI Calculator.

What is the EMI for a ₹5 Lakh Loan in 2025?

Whether you’re taking a personal loan, a car loan, or even an education loan, the EMI for ₹5 lakh depends mainly on three factors:

- Your loan tenure (in years)

- The interest rate offered by the bank

- When you start your repayments

Let’s take an example with some average figures from 2025:

- Loan Amount: ₹5,00,000

- Interest Rate: 10% per annum

- Loan Tenure: 5 years

EMI Calculation (Manual Example)

We use the standard EMI formula:

EMI = [P × R × (1+R)^N] / [(1+R)^N – 1]

Where:

| Symbol | Meaning | Example Value |

|---|---|---|

| P | Principal Loan Amount | ₹5,00,000 |

| R | Monthly Interest Rate (Annual Rate ÷ 12 ÷ 100) |

10 ÷ 12 ÷ 100 = 0.00833 |

| N | Number of Monthly Installments | 5 years = 60 months |

When you plug in these values, the monthly EMI comes out to approximately:

₹10,624

This means you’ll pay ₹10,624 every month for 5 years — and by the end of your loan, you would have paid around ₹1,37,440 in interest alone.

💡 Not a math person?

No problem.

Just scroll down and use my Free AI EMI Calculator — it auto-calculates EMI based on your entered amount, interest, and tenure.

In the next section, we’ll explore how EMI varies when you change tenure or interest rate…

₹5 Lakh Loan EMI for Different Tenures and Interest Rates

When you’re planning to take a ₹5 lakh personal loan, the EMI amount you’ll pay every month largely depends on two things — the loan tenure and the interest rate offered by the lender.

To help you understand this better, here’s a quick look at how your EMI changes across different durations (2, 3, 5, and 10 years) at popular interest rates.

This helps you plan more effectively and choose a tenure that suits your monthly budget.

| Tenure | Interest Rate | Monthly EMI | Total Payment | Total Interest |

|---|---|---|---|---|

| 2 Years | 10% | ₹23,072 | ₹5,53,728 | ₹53,728 |

| 3 Years | 11% | ₹16,369 | ₹5,89,284 | ₹89,284 |

| 5 Years | 12% | ₹11,122 | ₹6,67,320 | ₹1,67,320 |

| 10 Years | 13% | ₹7,438 | ₹8,92,560 | ₹3,92,560 |

How to Calculate ₹5 Lakh EMI Manually with Formula (With Example)

Not everyone wants to rely on tools — some prefer to understand the manual math behind loan EMIs.

If you’re curious how banks calculate your EMI, here’s the step-by-step breakdown using the standard formula.

But don’t worry, it’s simple once you know the formula.

We use the standard EMI formula:

What each variable means:

| Symbol | Meaning | Value Example |

|---|---|---|

| P | Principal Loan Amount | ₹5,00,000 |

| R | Monthly Interest Rate (Annual ÷ 12 ÷ 100) | 10 ÷ 12 ÷ 100 = 0.00833 |

| N | Loan Tenure in Months | 5 Years = 60 Months |

Example Calculation:

Let’s say:

- Principal (P) = ₹5,00,000

- Interest Rate (Annual) = 10%

- Tenure = 5 Years (60 Months)

Monthly Interest Rate (R) = 10 ÷ 12 ÷ 100 = 0.00833 EMI = [500000 × 0.00833 × (1 + 0.00833)^60] / [(1 + 0.00833)^60 – 1] EMI ≈ ₹10,623/month

So, for a ₹5 lakh personal loan over 5 years at 10% interest, you’ll pay ₹10,623 every month.

Want to skip the math and save time?

Try our Free EMI Calculator – just enter your loan amount, interest rate, and tenure to see your exact EMI with total payment and interest.

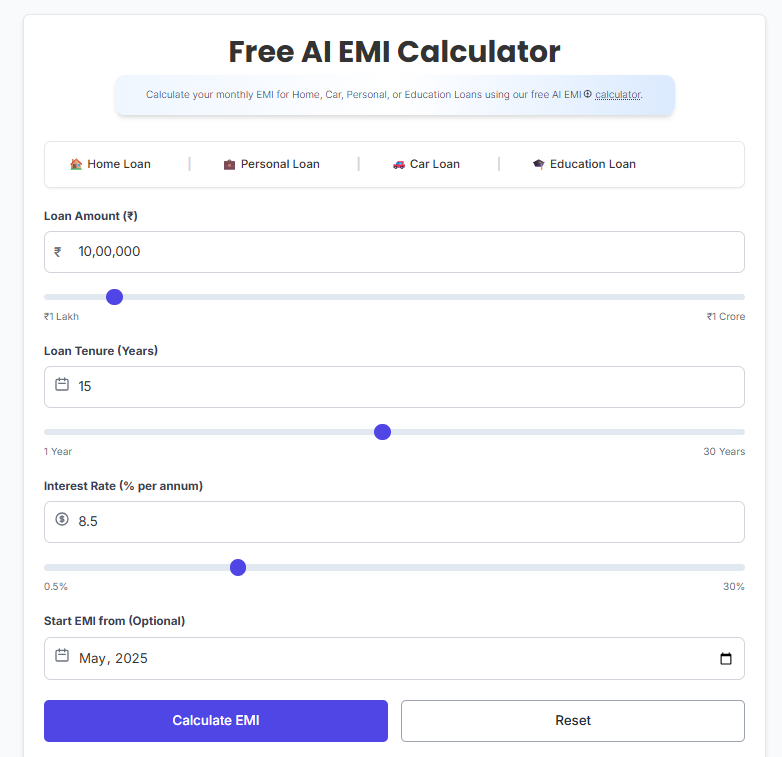

Step-by-Step Guide: Use EMI Calculator to Get Exact EMI

Want a quick and accurate way to know your monthly loan payments?

Here’s a simple step-by-step guide to help you use an EMI Calculator and instantly find out your EMI for any loan amount, interest rate, or tenure.

Follow these easy steps:

Step 1: Enter Your Loan Amount

Type the total amount you want to borrow.

Example: ₹5,00,000

Step 2: Enter Interest Rate (%)

Put the annual interest rate offered by the bank or lender.

Example: 10%

Step 3: Choose Loan Tenure

Select how long you want to repay the loan — in months or years.

Example: 5 Years (or 60 Months)

Step 4: Click “Calculate”

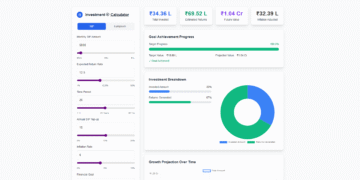

Just tap the calculate button — the EMI Calculator will show:

- Your Monthly EMI

- Total Interest Payable

- Total Repayment Amount

Why Use the EMI Calculator?

- No manual calculations needed

- Get instant, accurate results

- Compare different interest rates and loan durations

- Make better financial decisions

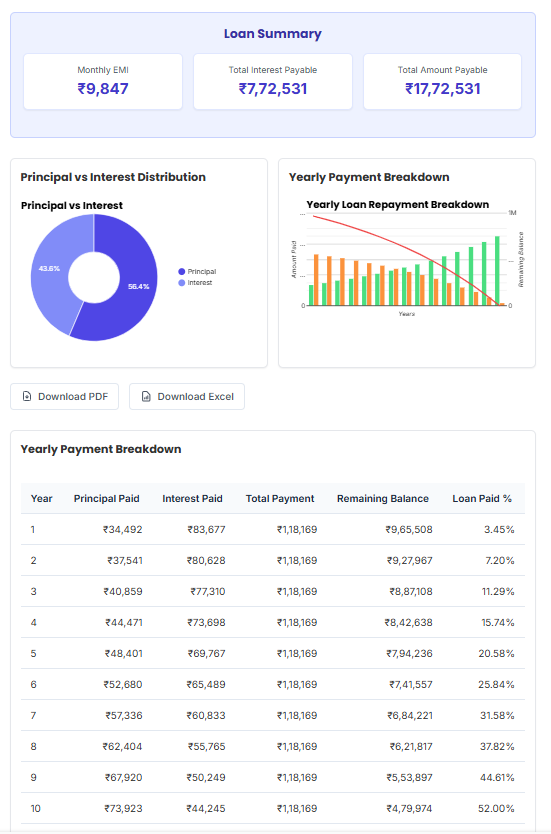

Pro Tip: Our EMI Calculator also lets you visualize your loan with pie charts and bar graphs, helping you see how much interest you’re paying over time.

🖼️ You can also refer to the image below for a clear example of how the EMI breakdown looks.

Why You Should Always Use an Online EMI Calculator Before Applying

Applying for a personal loan without using an EMI calculator is like driving with a blindfold — risky and unpredictable.

Before you finalize any loan deal, it’s crucial to know exactly how much you’ll be paying every month.

That’s where an online EMI calculator becomes your best financial tool.

Key Reasons to Use an EMI Calculator First:

✅ 1. Know Your Monthly Budget

Avoid surprises! Know in advance how much money will go out every month so you can plan your expenses wisely.

✅ 2. Compare Different Loan Offers

Change the interest rate or tenure and instantly see how your EMI and total cost change. This helps you choose the best loan with the lowest interest burden.

✅ 3. Save Time & Avoid Manual Errors

Forget complicated formulas and spreadsheets. A smart EMI calculator gives you accurate EMI results in seconds.

✅ 4. Visual Loan Breakdown

Modern EMI tools (like ours) show pie charts, graphs, and breakdowns of principal vs interest, helping you understand where your money is going.

✅ 5. Loan Planning Made Easy

With the calculator, you can test different scenarios — like 2-year vs 5-year loans — and pick what suits your income and financial goals.

Remember: Even a small change in interest rate or loan tenure can have a big impact on your total repayment. So always use an EMI calculator to make informed decisions.

Final Thoughts: Plan Smartly Before Taking That ₹5 Lakh Loan

Taking a ₹5 lakh personal loan in 2025 can be a wise decision—if you plan your EMI smartly.

Whether you’re borrowing for medical needs, education, home renovation, or a wedding, understanding your monthly EMI is crucial to avoid future stress.

Thanks to online EMI calculators, you don’t have to guess anymore.

You can experiment with interest rates, change tenure, and instantly know how much you’ll repay overall.

✅ Before applying for your loan, try different combinations using our free EMI calculator.

📊 Compare 2-year, 3-year, 5-year, and 10-year options.

📉 Find the right balance between EMI amount and total interest.

This one simple step can save you thousands of rupees over the loan period.

💡 Make your financial decision with full clarity, not confusion.