Are you planning to close your HDFC Demat account?

Whether you’re consolidating your investments, switching brokers, or simply no longer need it, the process is now more straightforward than ever. But before you begin, there’s a crucial step that many people miss: you must first close your HDFC Securities trading account.

This guide will walk you through every single step of the online closure process for your HDFC Demat account, helping you avoid common mistakes and complete the process smoothly.

Why You Must Close Your HDFC Trading Account First

It’s easy to get confused between a Demat account and a trading account, but they serve two distinct purposes:

- Demat Account: This is your digital locker for shares and securities. It holds your investments electronically.

- Trading Account: This is what allows you to buy and sell those shares on the stock market.

HDFC Bank requires you to close your trading account first because the two accounts are linked.

If you try to close your Demat account first, the request will be rejected, leading to frustrating delays.

Closing the trading account first ensures a seamless process and prevents any complications with your remaining holdings.

Learn How to Close HDFC Securities Trading Account Online

How to Close HDFC Demat Account Online (Step-by-Step Guide)

Follow these steps carefully to ensure a smooth and error-free account closure:

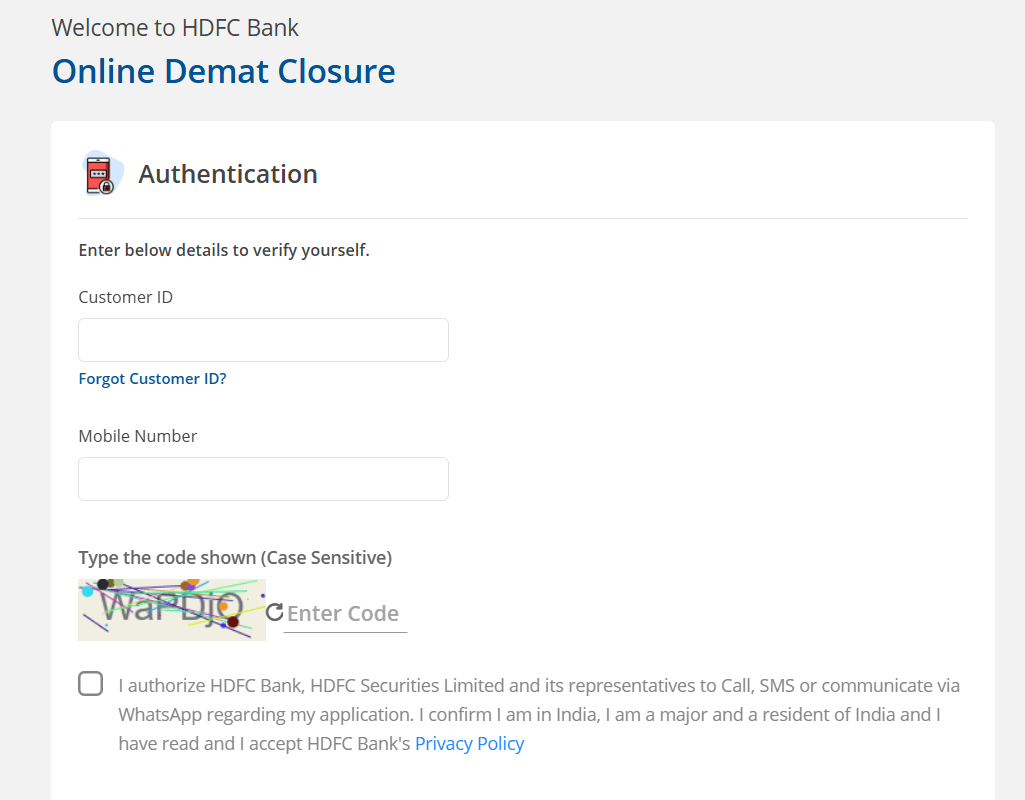

Step 1: Visit the Official HDFC Demat Closure Portal

- Navigate to the official closure link:

https://digiapply.hdfcbank.com/vivid/dematclosure. - Enter your Customer ID, registered mobile number, and the Captcha code. Tick the “I Authorize” box and click Login.

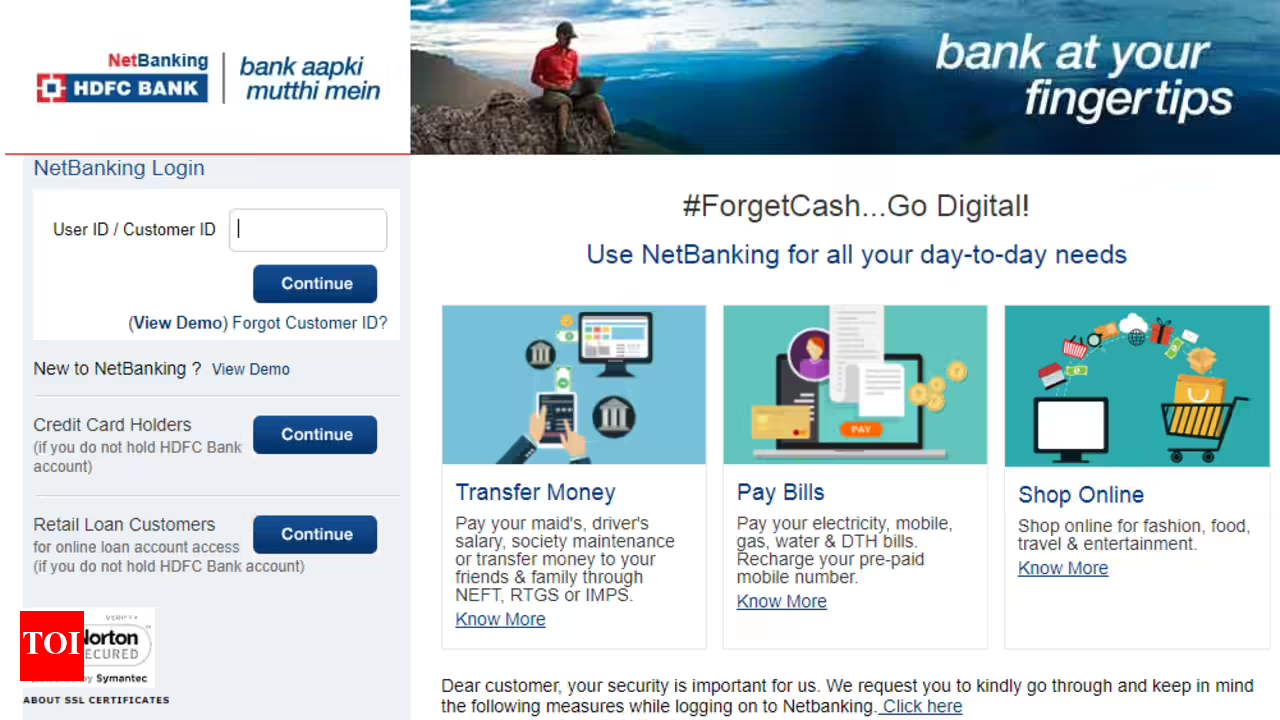

Step 2: Log In Using HDFC NetBanking

On the next page, you’ll be prompted to log in with your HDFC NetBanking credentials.

- Enter your NetBanking Customer ID and password, then click Login.

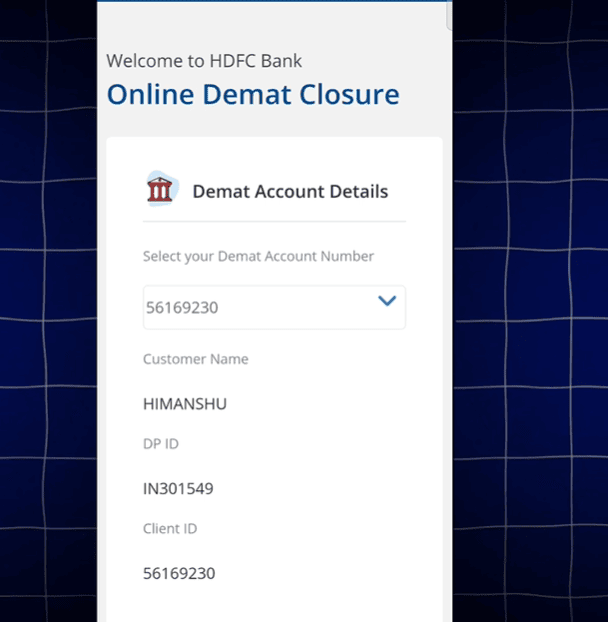

Step 3: Fill Out the Online Demat Closure Form

After logging in, the Online Demat Closure Form will appear, pre-filled with your account details.

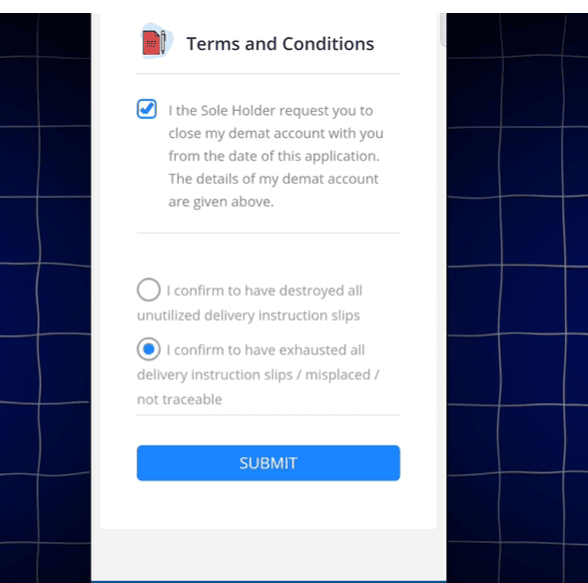

Carefully verify all the information. Scroll down, check the Terms and Conditions box, and click Submit.

Step 4: Verify the OTP on Your Mobile

An OTP (One-Time Password) will be sent to your registered mobile number.

Enter the OTP in the provided field and click Continue.

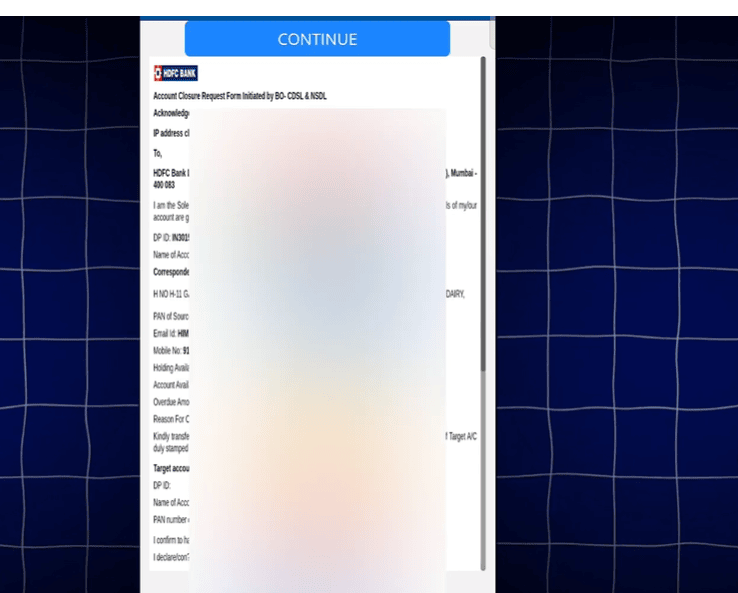

Step 5: Review and Confirm Your Details

The Account Closure Request Form will open. Take a moment to review all your Demat account details one last time for accuracy.

Once confirmed, click Continue.

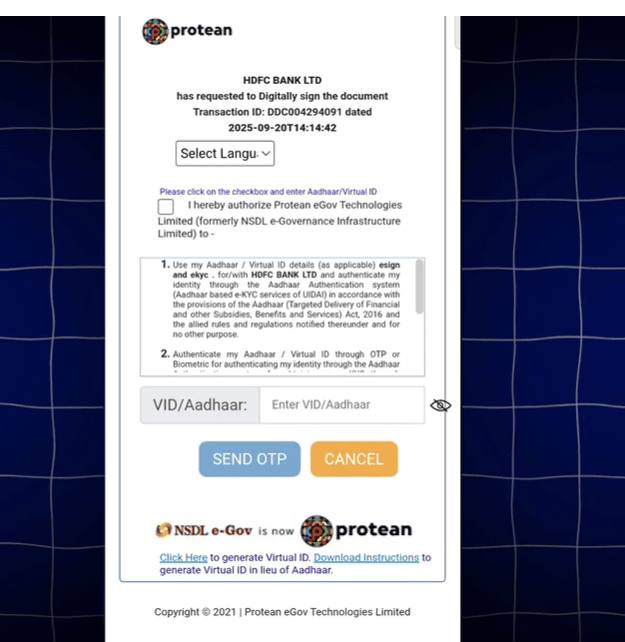

Step 6: Digitally E-Sign with Aadhaar

This is the final and most important step.

Enter your Aadhaar Card Number.

Click Send OTP.

Enter the OTP received on your Aadhaar-linked mobile number and click Verify OTP to complete the e-sign process.

Step 7: Confirmation of Closure Request

Once successful, you will see a confirmation message: “Closure request is submitted successfully.”

Your HDFC Demat account will be processed and closed within 7 working days.

Expert Tips for a Smooth Closure Process

- Clear Your Holdings: Make sure you have no active holdings in your Demat account. Either sell or transfer all your shares before submitting the closure request.

- Download Statements: For future reference, download and save copies of your account statements.

- Verify Your Details: Double-check your name, Customer ID, and mobile number to avoid any OTP or e-sign errors.

- Keep Your Documents Ready: The e-sign process requires Aadhaar verification, so keep your Aadhaar details handy.

What Happens After You Submit the Request?

After you submit your online closure request:

HDFC Bank will begin processing your application.

Your Demat account will be deactivated and permanently closed within 7 business days.

You will receive a confirmation notification from HDFC Bank once the account is successfully closed.

Remember, this closure is irreversible, so be certain you have saved all necessary data and documents beforehand.