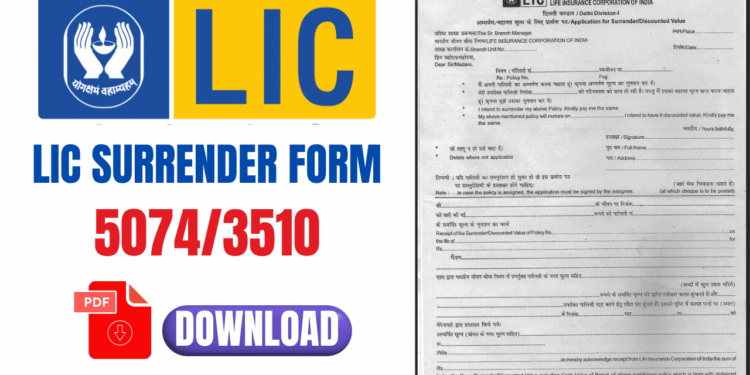

If you are planning to close your LIC policy before maturity, you need to properly fill out the LIC Policy Surrender Form (Form No. 5074/3510) and submit it to your nearest LIC branch.

Many policyholders want to surrender their policies early, but a lack of proper guidance on the process and required documents often causes confusion and delays.

In this comprehensive guide, we will explain how to download the LIC Surrender Form PDF, fill it correctly, submit it to the branch, and check how much money you will receive along with the estimated timeline for receiving it in your bank account.

By the end of this article, you will learn:

- ✔ How to download the LIC Surrender Form 5074 PDF

- ✔ Step-by-step process to surrender an LIC policy

- ✔ List of required documents for surrender

- ✔ How long does it take to get the surrender amount

If you are thinking of closing your LIC policy, this guide will make the process simple and hassle-free.

LIC Surrender Form PDF Download

Before surrendering your LIC policy, you must first download the LIC Surrender Form (Form No. 5074/3510). This form is mandatory for closing any LIC policy.

💡 Check out our Finance Tools:

Where to Download LIC Policy Surrender Form 5074/3510 PDF

You can download the form from multiple sources:

1. Direct PDF Link:

Click the link below to download the LIC Surrender Form 5074/3510 in Hindi PDF for free:

💡 Click here to download PDF:

2. LIC Official Website:

- Visit www.licindia.in

- Go to the “Forms” section.

- Search for Surrender Form (Form No. 5074/3510).

- Download and print the form.

3. LIC Branch Office:

Visit your nearest LIC branch and request the form. The branch officials will also guide you on how to fill it correctly.

4. LIC Agent:

If you purchased your policy through an LIC agent, they can provide the form and explain the surrender process.

📢 Important Note:

Always fill the form with a black ink pen. Incorrect or incomplete forms may be rejected.

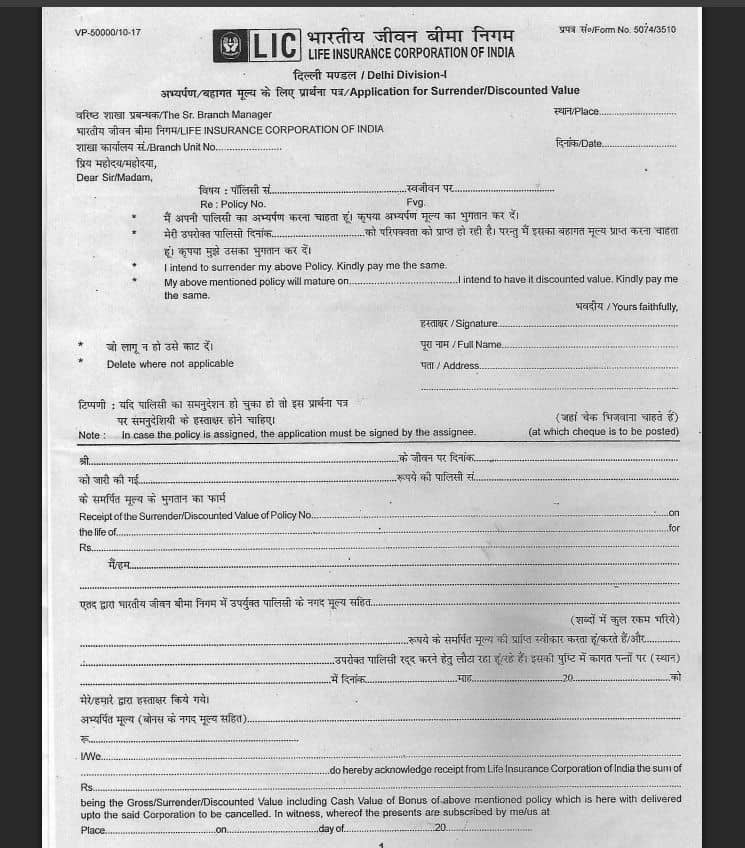

How to Fill LIC Surrender Form

Filling the LIC Surrender Form 5074/3510 correctly is crucial for smooth processing. Below is a step-by-step guide:

1. Fill the Application Details | |

|---|---|

| Place: | Write the city or town where you are filling the form. |

| Date: | Mention the date of application. |

| Branch Unit Number: | Enter the unit number of the branch where you are submitting the form. |

| Dear Sir/Madam: | Address the LIC branch manager here. |

2. Provide Policy Details | |

|---|---|

| Policy Number: | Write your LIC policy number. |

| FVG Number: | This is a unique number found in your LIC policy documents. |

3. Specify Surrender Request | |

|---|---|

| Full Policy Surrender: | Tick the option – “I intend to surrender my above Policy. Kindly pay me the same.” |

| Discounted Value Surrender: | Tick the option – “I intend to have it discounted value. Kindly pay me the same.” |

4. Signature and Address | |

|---|---|

| Full Name: | Enter your complete name. |

| Address: | Fill in your current or permanent address. |

| Signature: | Sign in the designated place on the form. |

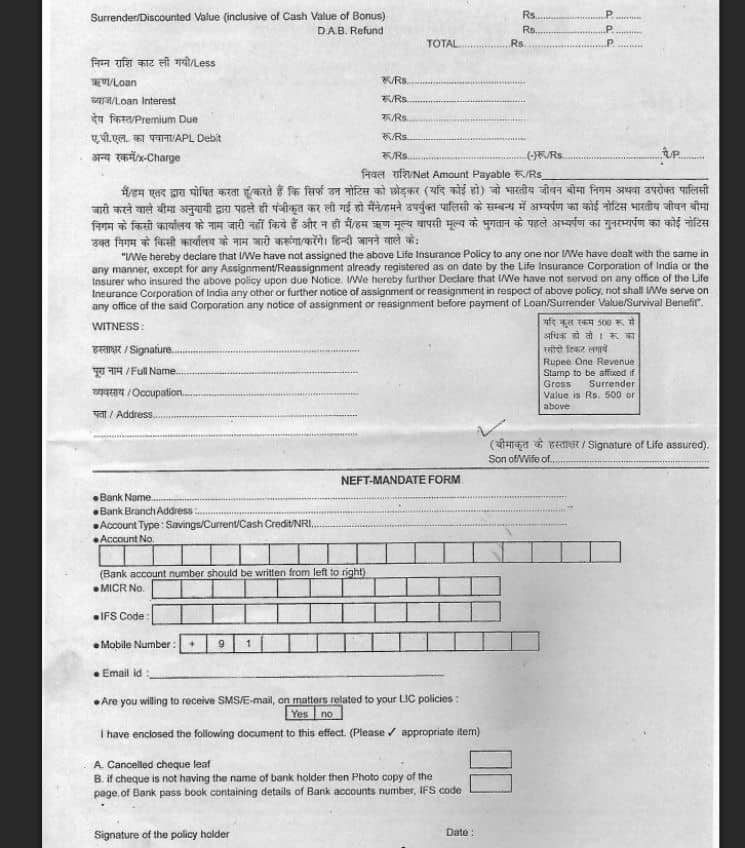

5. Bank Account Details (NEFT Mandate Form) | |

|---|---|

| Bank Name: | Enter the bank where you want the surrender amount transferred. |

| Branch Address: | Write the full branch address. |

| Account Type: | Choose Savings/Current/Cash Credit/NRI. |

| Account Number: | Enter your bank account number correctly. |

| MICR Code: | Provide your bank's MICR code. |

| IFSC Code: | Fill in your bank branch’s IFSC code. |

| Mobile Number: | Enter your 10-digit mobile number. |

| Email ID: | Provide email if you wish to receive email notifications. |

| SMS/Email Alerts: | Tick “Yes” if you want updates via SMS or email. |

6. Attach Required Documents

Include one of the following with your form:

- Cancelled Cheque: Must have your name printed on it.

- Bank Passbook Copy: If your cheque does not have your name.

7. Final Signatures and Witness

- Policyholder Signature: Sign at the bottom.

- Witness Signature: A family member or friend can act as a witness.

Submitting the LIC Surrender Form

Once submitted, the LIC branch will provide a receipt for your surrender request. The money will typically be credited to your bank account within 7 to 10 business days.

If there are any issues, you can contact LIC Customer Care for assistance.

Required Documents for LIC Policy Surrender

To successfully surrender your LIC policy, ensure you have the following documents:

| LIC Surrender Form (Form No. 5074) | – completely filled and signed. |

| Original Policy Bond | – issued by LIC. |

| Aadhaar Card & PAN Card | – self-attested copies. |

| Cancelled Cheque | – must show account holder name and IFSC. |

| Bank Passbook Copy | – if cheque does not include name. |

| Passport Size Photo | – sometimes required by the branch. |

| Revenue Stamp of ₹1 | – if applicable. |

| Acknowledgment Receipt from LIC Branch | – proof of submission. |

| Assignee Signatures | – if the policy is assigned to another person. |

Step-by-Step LIC Policy Surrender Process

- Visit your nearest LIC branch and obtain Form No. 5074 (Surrender Discharge Voucher).

- Carefully fill the form and attach all necessary documents.

- Submit the form at the branch.

- LIC will process your surrender request.

- Once approved, the surrender value will be transferred to your bank account.

If you cannot visit the branch, you can courier the discharge voucher and documents to LIC’s Mumbai Head Office.

How to Surrender LIC Policy Online

If you wish to surrender your policy before maturity online, follow these steps:

- Visit the LIC official website and log in to your account.

- Download the Surrender Discharge Voucher (Form No. 5074).

- Fill the form correctly and attach the required documents.

- Submit the form and documents online.

- Once accepted, the surrender process begins, and the money is credited to your registered bank account.

Note: Online surrender may not be available for all policies. Confirm with LIC customer care or your branch first.

Things to Consider Before Surrendering Your LIC Policy

Surrendering an LIC policy may not always be the best financial decision. Here are key points to consider:

1. Is Surrender Beneficial?

Surrendering early may result in low returns. If your policy is less than 3 years old, the surrender value is usually very low or zero. After 3 years, you may receive a certain percentage of the policy’s value.

2. How Much Money Will Be Deducted?

You may get Guaranteed Surrender Value (GSV) or Special Surrender Value (SSV):

- Guaranteed Surrender Value: Up to 30% of total premiums paid, excluding first-year premium and bonuses.

- Special Surrender Value: Depends on policy tenure, premium payments, and maturity amount.

Policies held for 10 years or more usually yield a better surrender value.

3. Alternatives to Surrender

If you don’t want to close your policy, consider these options:

- Loan Against Policy: Borrow money against your LIC policy at a low interest rate. Your policy remains active, and you get financial support.

- Paid-up Policy: If you cannot pay future premiums, your policy can become paid-up. It will continue but with reduced maturity or death benefits.

These options may be better than surrendering since you avoid losing money and retain some benefits.

LIC Frequently Asked Questions (FAQs)

Conclusion

In this guide, we covered how to download LIC Surrender Form 5074/3510 PDF, steps to fill it, required documents, and precautions before surrendering your policy. By following these steps, you can safely and easily surrender your LIC policy and receive your surrender amount without unnecessary delays.

Always consider alternatives like Loan Against Policy or Paid-up Policy before surrendering to maximize your financial benefit.